- Published on

What is the cushion

- Authors

- Name

- Cushion

- @cushiondottrade

Imagine you start with a portfolio of $100. You want to protect your capital — say, never fall below 80% of your highest historical value.

This 80% is called your protection level, or the floor.

But how do you manage risk dynamically?

That’s where the Cushion comes in:

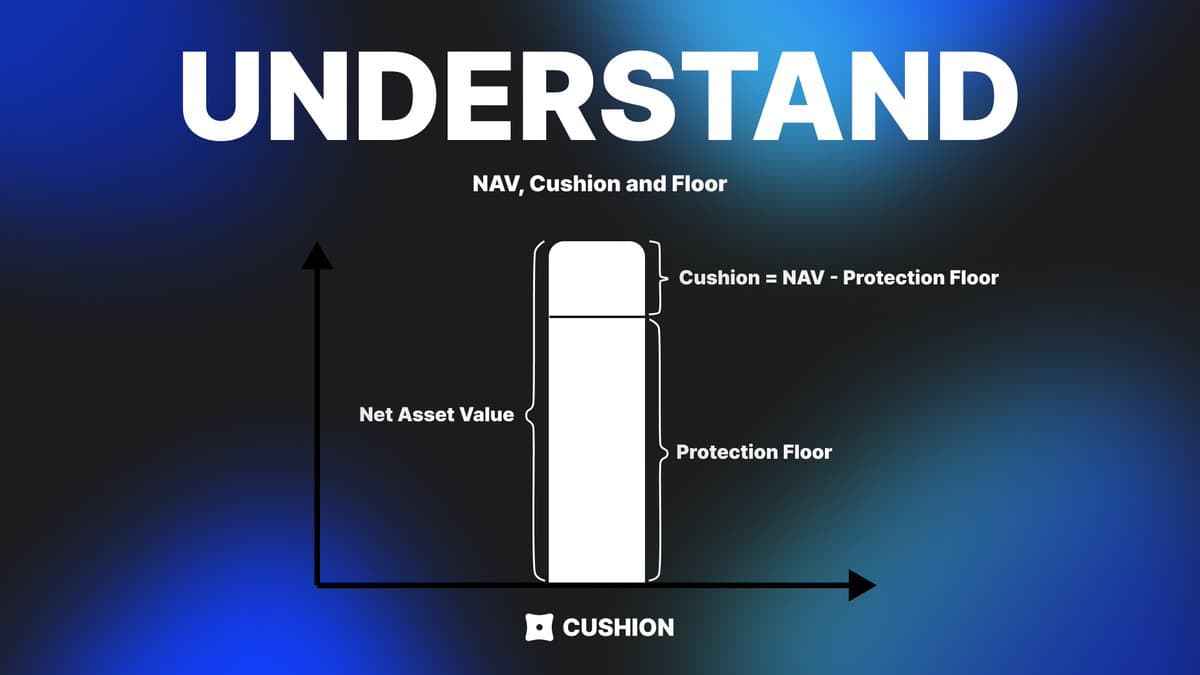

Cushion = NAV (Net asset value) − Floor

The floor isn't fixed, it updates with the highest NAV. So your Cushion is always the buffer above your 80% protection level.

It's what protects your portfolio.

Here’s a simple example:

Start NAV: 100 Floor: 80 (80% of 100) if NAV goes up to 120, floor becomes 96 (80% of 120)

Cushion = 120 - 96 = 24

Now you’ve got more room to take risk!

But when NAV drops?

Say NAV falls from 120 to 100, the floor stays at 96, so the cushion shrinks: Cushion = 100 - 96 = 4

Now your risk budget is small — the strategy will shift toward safer assets.

In short, the cushion tells you how far you are from your protected capital.

It:

🔹Expands when markets go up → allows more growth allocation

🔹Contracts when markets go down → triggers protection

Dynamic and adaptive.

This is why... Cushion

Because it’s the safety buffer that helps you grow, without risking too much.

We do the math. You get peace of mind.